المواضيع الرائجة

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

تم بث Pendle منذ أقل بقليل من أسبوعين وتجاوز بالفعل 300 مليون دولار في TVL.

في HyperLend ، نحن من كبار المؤيدين لنهج Pendle في كفاءة رأس المال وفتح فرص ذات عائد أعلى.

لقد قمنا مؤخرا بإعداد PT-kHYPE كضمان على HyperLend وتمكين E-Mode ، مما يسمح للمستخدمين بتكرار PT-kHYPE<>HYPE واستهداف عوائد تصل إلى 20٪ APY.

فيما يلي تفصيل للتقرير الأخير من @BlockAnalitica.

// Summary

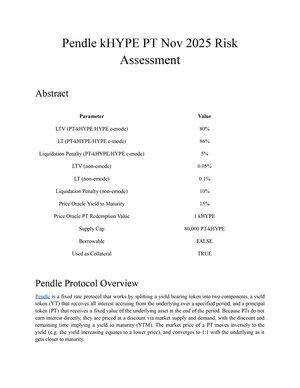

Pendle’s kHYPE Principal Token (PT), maturing November 13, 2025, on HyperLend, splits yield-bearing assets into Yield Tokens (YT) and PTs, with PTs priced at a market-driven discount for a fixed maturity payout.

Risks include low technical issues, backed by audits and Pendle’s $1B+ TVL, and duration risk, where PT prices shift inversely to yields, impacting volatility and liquidity.

A bgdlabs-developed linear discount oracle prices PT-kHYPE at 15% YTM, supported by Spectra kHYPE data showing stable 15% APY, reducing liquidation and manipulation risks compared to AMM TWAP.

Proposed e-mode settings: 80% LTV, 86% LT, 5% liquidation penalty; non-e-mode at 0.05% LTV and 0.1% LT to limit unrelated asset debt. A 80,000 PT-kHYPE supply cap addresses Pendle AMM pool liquidity constraints, with PT borrowing discouraged to ensure redemption stability.

As of July 30, 2025, with 106 days to maturity, the 15% YTM guards against 50% yield spikes, keeping LTVs below 100% (~93% at maturity). These settings prioritize market stability, collateral safety, and liquidity. HyperLend, with Block Analitica’s risk expertise.

Bank wiser, HyperLend.

19.63K

الأفضل

المُتصدِّرة

التطبيقات المفضلة