المواضيع الرائجة

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

أخبار عاجلة عن فوضى المشبك من @mikulaja

"بينما وجد أمر كاليفورنيا أن جونو متورطة في نشاط مخادع لأخذ الودائع ويدعو إلى التعويض للمستخدمين النهائيين وعقوبات قدرها 2,500 دولار لكل انتهاك [لقانون] الولاية ، يبدو من غير المرجح أن يتقاضى كلاهما أموالا على الإطلاق."

28 أغسطس 2025

🚨BREAKING: Evolve Bank service provider, Synapse client Juno hit with cease & desist, demand to pay users restitution by California regulator:

A new complaint from the California Department of Financial Protection and Innovation orders crypto and banking app Juno to cease deposit taking activities in the state and to make restitution to Juno users in the state for outstanding unpaid balances in cash management accounts as a result of funds being frozen when middleware provider Synapse collapsed last year.

Beginning in at least 2020, Juno partnered with Evolve, via Evolve's service provider Synapse, to offer and market Evolve checking accounts to California customers.

In or around October 2023, Juno informed end users it would transition to offering brokerage cash management accounts, though users would retain a deposit account at and debit card issued by Evolve.

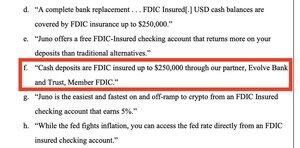

The DFPI's complaint notes that Juno's marketing makes heavy use of "FDIC" claims (as shown in image below), including specifically referring to the crypto app's "partnership" with Evolve.

Evolve knew, or should have known, about the marketing claims its service providers, Synapse and Juno, were making on its behalf.

And, according to a sworn declaration filed in the bankruptcy case, Evolve played an active role in reviewing Juno's marketing materials.

Andre Herrera, Juno's chief compliance officer, wrote in signed declaration that, "It was my understanding and experience that Evolve played a direct role in reviewing and approving (by objecting to) customer-facing materials. This understanding was confirmed through communications that Synapse relayed to Juno, including direct feedback from Evolve's compliance personnel."

California's order, though, amounts to too little, too late. Juno is no longer accepting new users, and the company appears to have last raised funding, an $18 million Series A, in Oct 2022, suggesting it has few, if any resources remaining.

While California's order finds that Juno engaged in deceptive deposit-taking activity and calls for restitution to end users and penalties of $2,500 per each violation of the state's California Consumer Financial Protection Law, both seem unlikely to ever get paid.

1.89K

الأفضل

المُتصدِّرة

التطبيقات المفضلة