Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Learning Pill 💊

Curating crypto alfa, insights and new projects so you can make it //

Nothing here is financial advice.

DeFAI isn’t just “AI + DeFi.”

it’s the shift from human-governed yield to machine-governed capital flows - and these two protocols are positioning themselves as early category winner👇

for @almanak → $ALMANAK TGE soon in a couple days’ time and many eyes are on it

• TVL hit 170M+ ATH and has stabilised despite 10/10 event

• withdrawals are smooth and gives assurance that funds can be taken out

• strategy builder can be a useful tool for users to explore and ‘build their own quant team’

• Almanak hunt + Almanak games for more community involvement + rewards as part of post TGE GTM

if this works out, it could set precedence to other launches

the real determinant of early price stability is whether the highest-XP players commit to vested exits - that behaviour alone dictates early order flow expectations

on to @Infinit_Labs → $IN distribution rails continue to scale

• from integrations with @googlecloud to @BinanceWallet , @Gate , @BitgetWallet , and expanding across ecos like Arbitrum, Base, HyperEVM, MegaETH, Monad as well as @virtuals_io

• enhancing the agentic infra by involving @eigencloud as a credible verification layer

• prompt-to-defi coming right up which eases AND elevates the utility of agentic platforms → type out what you want and agents will settle it for you

as we know it - this form is but a section of crypto x AI, and will surely scale much larger in the future

there is still the untapped potential of institutional DeFAI demand - and this could be a scale up of curator-model

higher for DeFAI

The Learning Pill 💊Nov 20, 2025

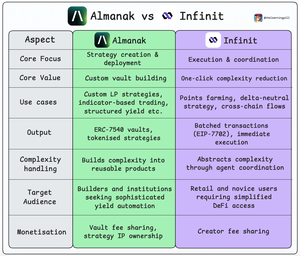

Agentic DeFi is bifurcating → one lane for creating strategies, and another for executing them

and the clearest examples of this split are @almanak and @Infinit_Labs

they look similar on the surface (AI swarms, automation, speed), but they solve entirely different problems - which is why the community sees them as complementary, not competitive

let's look at how they compare in their approach, audience, and PMF 👇

--------------------

@almanak approaches DeFi like an AI-powered quant desk

its 18-agent system takes user inputs → LP ranges, RSI triggers, hedging rules - and handles everything from research to coding to simulation to deployment

the output? fully verifiable ERC-7540 vaults that behave like reusable yield products

this attracts a very specific crowd: builders, quants, treasury managers, and advanced users who actually want to craft and own their strategies

~13K users already treat Almanak as their strategy workshop

comparing to @Infinit_Labs , its all about frictionless execution

you describe your goal in plain language → “maximise ETH yield with delta-neutral exposure” or “farm points across L2s efficiently” - and its 30+ agents coordinate a multi-step, cross-chain workflow batched into one click

in fact, when their prompt-to-DeFi functionality is made available, strategy creating convenience will be taken to the next level

this resonates w the other side of the market: retail, beginners, and anyone who wants to do complex things w/o touching DeFi’s complexity

w 558K+ wallets connected, and recent integrations w @BinanceWallet and @GateWeb3_HQ , Infinit is clearly building for mass adoption

--------------------

zooming out, their roles in the broader agentic DeFi stack become obvious:

Almanak = the creation layer

it solves the strategy-building gap → turning ideas into structured, auditable, deployable vaults that institutions can trust

Infinit = the execution layer

it solves the execution gap → turning intent into action across multiple chains and protocols, w/o the user ever needing to open 10 tabs

and that’s why there’s no competitive tension

they’re solving different pain points for different audiences, on different ends of the same workflow

if anything, the market increasingly sees a natural synergy forming between the two: strategies created on Almanak eventually being executed through Infinit’s natural-language interface

creation → distribution → execution

the building of a full agentic pipeline

what other comparisons would you want to see?

3.48K

many trading platforms out there but on @OstiumLabs , you get...

• predictable rollover costs

• top-of-book depth for size w/o much slippage

• multi-asset access to crypto, equities, FX, commodities

• simple execution, wallet-native, no greeks, no noise

if you want a place to express macro conviction on your own terms, Ostium is already there

probably one of Pill's top spots for equities/commodities trading

kaledoraDec 6, 01:02

silver on the verge of breakout, gold faltering

reminder that ostium is the only place to trade both metals in size onchain!

1.56K

Top

Ranking

Favorites