Rubriques tendance

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

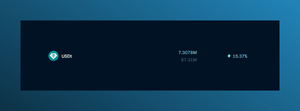

explainer on utilization and spikes

utilization = share of assets that are borrowed vs supplied. when 90%+ of a pool is borrowed, lenders can suddenly earn huge apr because borrowers compete for limited liquidity. right now usdt lending shows ~15% apr because utilization spiked. but these moments are usually short - once new supply enters or demand cools off, rates normalize. think of it like surge pricing: high while the imbalance exists, then gone

how to use this:

– watch utilization dashboards closely, because the edge only lasts hours not weeks

– if you have idle stablecoins, you can park them in pools during spikes to capture elevated rates

– don’t assume the apr you see on the screen is permanent. always check utilization % to understand if it’s sustainable

for those wanting steadier high apr, sUSDe on @EchelonMarket is a better option. it earns ~13% APR right now. more importantly, it can be looped:

1. supply sUSDe

2. borrow usdc (which is subsidized with incentives)

3. convert usdc back into sUSDe

4. repeat until you reach your risk tolerance (preferably >110% health factor)

done correctly, this pushes effective yield toward ~30% while keeping exposure mostly in stable assets

7,25K

Meilleurs

Classement

Favoris