トレンドトピック

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

この分析は素人っぽいです。マーケットメーカーは、うまく機能している市場における洗練されたプレーヤーです。もちろん、彼らは大きな動きをヘッジする必要があり、損失やその他のリスクを軽減するものを避けるために、マーケットメイキングしている相場も狙撃します。

2025年8月27日

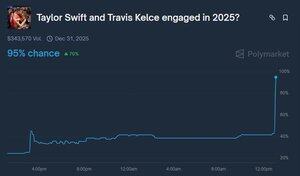

The prediction market chart for TSwift getting engaged shows a scenario where dual flow batch auctions (DFBA) shine over vanilla CLOBs.

If the market gaps to 1.0 in a CLOB the lowest latency taker gets an enormously profitable fill against the resting liquidity. The market maker takes a devastating loss, and has to make up by quoting wide and thin in normal times.

In a DFBA, as long as the info was at least semi public to multiple parties in the auction window, takers would compete on price not latency. If the market is quoting $0.56 but gapping to $1.00, it’s still profitable for me to bid $0.99 and try to access as much liquidity as possible. If I bid even a little bit lower, I likely lose the auction to a more aggressive taker.

Market makers can rest easy knowing they’re protected in a gap scenario. A problem that has particularly plagued discrete resolution prediction markets for a long time. That in turn gives the market makers the confidence to quote tight and deep, and ordinary users get better liquidity and prices.

All of that comes for free just by using a DFBAs instead of CLOBs

371

トップ

ランキング

お気に入り