Trendande ämnen

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Pre-IPO Crypto Projects: When Private Markets Meet Permissionless Rails

Intro

Bullish on new frontiers such as biotech, space exploration or robotics but unsure how to get exposure? Or you’re dying to short @cluely because you think it’s just a marketing scam?

“Pre-IPO” is basically how investors can get exposure to a company before it lists on a public exchange (NASDAQ or NYSE).

Traditionally, only instis and UHNWIs could get access to this round via OTCs using specific fund vehicles. However all these come with high minimum amounts, tons of paperwork, and a very slow dealmaking process.

Meanwhile, most of the value creation in today’s modern tech companies now occurs while they remain private.

The result: retails are late to get exposure, and are often EL at the IPO.

This is where Pre-IPO crypto projects come by putting private-company exposure on open platforms: 24/7 markets, smaller tickets for individual investors with instant settlement.

So far there has been 2 approaches to this vertical:

• Backed-equity tokens (SPV model): where tokens represent economic rights to real shares held in a special-purpose vehicle (we focus more on this model in this piece)

• Synthetic markets (derivatives/perps): no underlying shares; users just trade a proxy for a company’s valuation and settlement is based on events/ oracle rules

- - - - -

Problems with the legacy setup

• Access: most need to be an accredited investor (AI) with high investment amounts - smaller investors are priced out. But change is brewing as the “Equal Opportunity for All Investors Act of 2025” just passed the House, directing the SEC to create a knowledge-based test. This could qualify investors based on market knowledge rather than just income or wealth, potentially opening pre-IPO deals to a much broader audience.

• Price discovery: IPO pricing can diverge sharply from true demand, retails often late to the party and used as EL (for example: @figma's IPO had a 4.3x day-one return, but the biggest gains went to early investors, now sitting on over $24B collectively. Source:

• Operational friction: transfers and settlements are often manual, and each country has a different jurisdiction regarding such investments (for example, access to U.S. private markets and pre-IPO opportunities is heavily limited in China/South East Asia, due to regulatory frameworks and investor restrictions)

Potential benefits of crypto rails

• Market structure: on-chain AMMs/order books create automated counterparties, you don’t need a pre-arranged buyer

• Fractional access: retails can invest as low as $10 for some products, makes it more accessible for the wider public

• Composability: like DeFi, such tokens could potentially be plugged into money markets or integrated in other structured products → finance legos

• Transparency & automation: on-chain attestations are available with programmatic and clear settlement rules

- - - - -

Current landscape

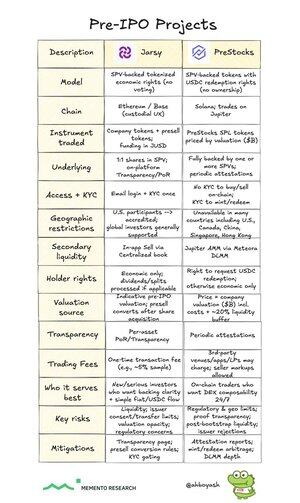

1. SPV Backed

a) @JarsyInc

• Intro: a consumer grade platform that issues 1:1 asset-backed tokens tied to shares held in an SPV → real pre-IPO exposure

• How it works: using email → complete KYC once → fund in stables (multi-currency on-ramps) → buy company-specific tokens with as low as $10 per investment

• New listings: users first buy a presell token using a dollar-pegged in-app stablecoin (JUSD). If Jarsy secures the shares, pre-sales convert into asset-backed tokens and a one-time platform fee applies (otherwise investors are issued refunds)

• Performance & traction: Jarsy has been live for a few months now with strong growth and engagement. Users have already captured massive upside such as:

>> @circle: Bought at $25 → stock hit $298

>> @AnthropicAI: +240% return (valuation grew from ~$60B → ~$200B)

>> @perplexity_ai: +101% return (valuation doubled from $9B → $18B)

• Alpha access: Many of these names are backed by T1 VCs and are years away from IPO, meaning retail users would otherwise be priced out

• Where Jarsy wins: global by design, global and non U.S. investors generally supported (subject to local rules), familiar web2/consumer UX and early proof-of-reserves/transparency

b) @PreStocksFi

• Intro: SPV-backed tokens on @solana priced directly off company valuation (in $B) and tradable via @JupiterExchange (uses @MeteoraAG for liquidity)

• How it works: small trades swap on-chain 24/7. Large holders can redeem for USDC (with KYC and processing). Offers instant composability (collateral) with no management/performance fees

• Trade-offs: geofencing is broad (many countries excluded such as U.S., Canada, Hong Kong and Singapore) and liquidity depth after launch depends on MMs and arbitrage

Jarsy is the right entry platform if you care about simple onboarding and verifiable backing. If you already live on Solana and want composability, PreStocks fits that profile more

2. Synthetic perps

a) @joinearlybird

• Intro: long/short perp markets on companies like SpaceX, OpenAI, Stripe → just pure price exposure

• How it works: prices determined by supply/demand between longs and shorts. Settlement occurs either at IPO or acquisition using the public valuation/share price

b) @ventuals_

• What it is: Perps on private-company valuations built on @HyperliquidX’s HIP-3 (builder codes) with an order book

• How it works: Each instrument represents “valuation units” (valuation ÷ 1B). Markets run continuously and funding controls prices toward an oracle that blends off-chain valuation references with on-chain marks

- - - - -

Core risks of this vertical

• Regulatory classification and limited to AIs: backed tokens seem like digital-asset securities → will encounter strict geofences (for example in Singapore these cannot be pitched to the general public; they either geofence Singapore or limit access to Accredited Investors (AIs) or Instis)

• Issuer pushback & transfer restrictions: Many private companies reject tokenized exposure; sourcing secondaries can be contractually constrained → legal risks is high

• Oracle & basis risk (synthetics): Private valuations update occasionally; oracle (data sources, EMAs, caps) can sometimes misrepresent reality

• Liquidity cliffs: After the launch hype fades, depth can thin out and cause problems for prices and sizing in and out → MM incentives determine spreads and slippage

• Operational & counterparty risks: KYC/AML, custody, wallet recovery and cross-border tax handling remain a big issue. Smart-contract bugs or oracle manipulation add to the technical risk

• Thin liquidity: Especially for the perp based projects, where users do not own the underlying spot asset, whales could manipulate market orders easily with size

- - - - -

Thoughts

The likely scenario is that both types of Pre-IPO exposure projects (backed-equity tokens and synthetics) will coexist and serve different set of users:

• Backed rails: for economic linkage and a path to redemption at major events

• Synthetics: more for speculation and hedging

As frameworks and regulations become clearer, I will be expecting more options, and structured products to be built on top of these primitives. DeFi once again proves that a once opaque market architecture can shift from closed deals to a more open, continuous and democratised market for private-company risk.

It represents a shift from traditionally high-barrier deals to a more dynamic and liquid opportunity for investors. Just like how DeFi transformed trading by eliminating intermediaries and creating 24/7 permissionless markets, the tokenization of private-company risk is setting the stage for similar breakthroughs in early-stage investing.

For platforms like Jarsy, other than access, it’s also about building the rails for the next generation of capital formation:

• Startups seeking broader, faster distribution of their equity

• Investors demanding liquid exposure to high-growth opportunities

• Crypto-native infra enabling real-time, compliant, and borderless participation

Been testing out Jarsy, try it out here:

28,85K

Topp

Rankning

Favoriter